A Fully regulated lending platform combining decentralized protocols with custodial standards to unlock real-world liquidity for high-net-worth clients across Europe

Bridging Crypo and Compliance for Secure Fiat Lending

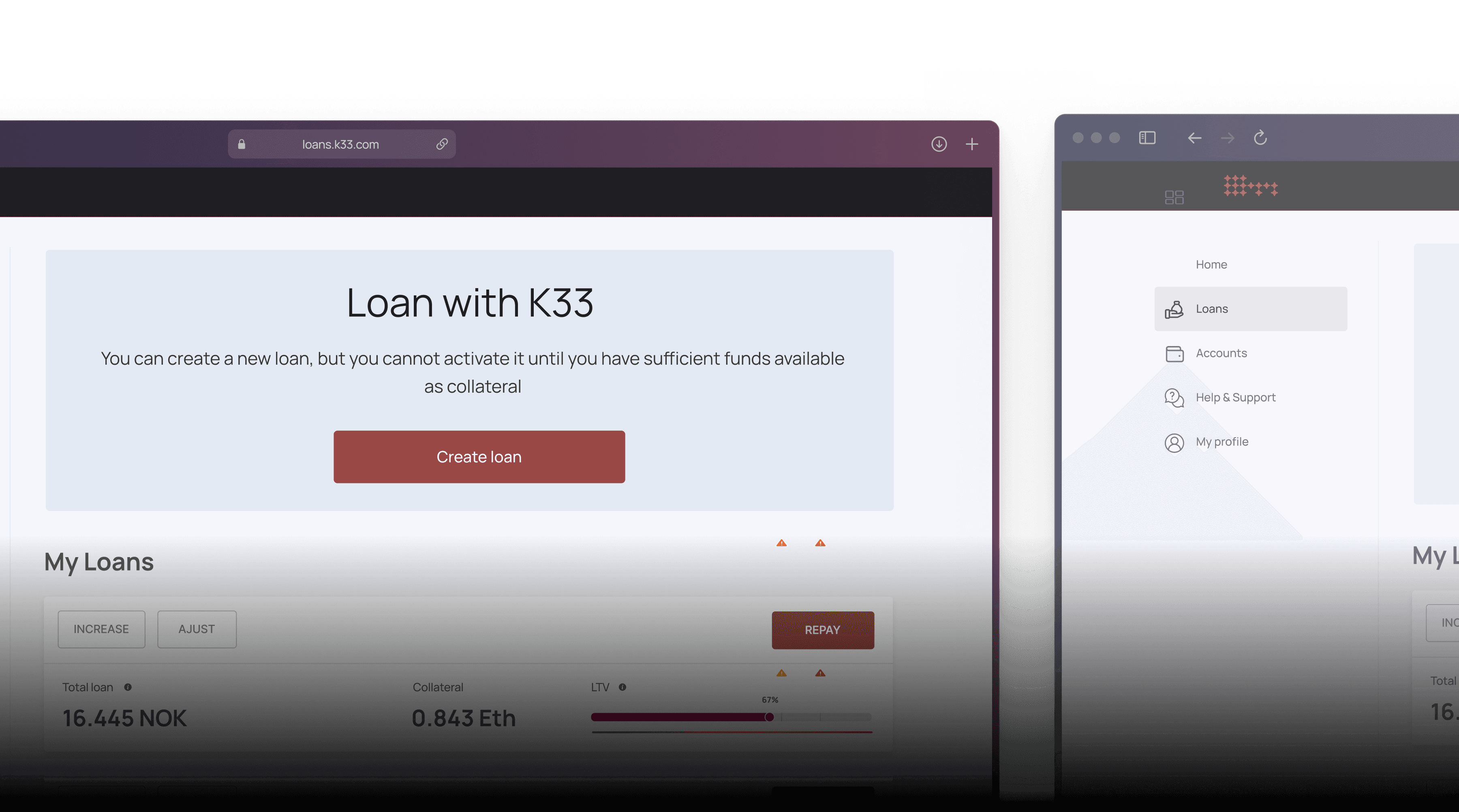

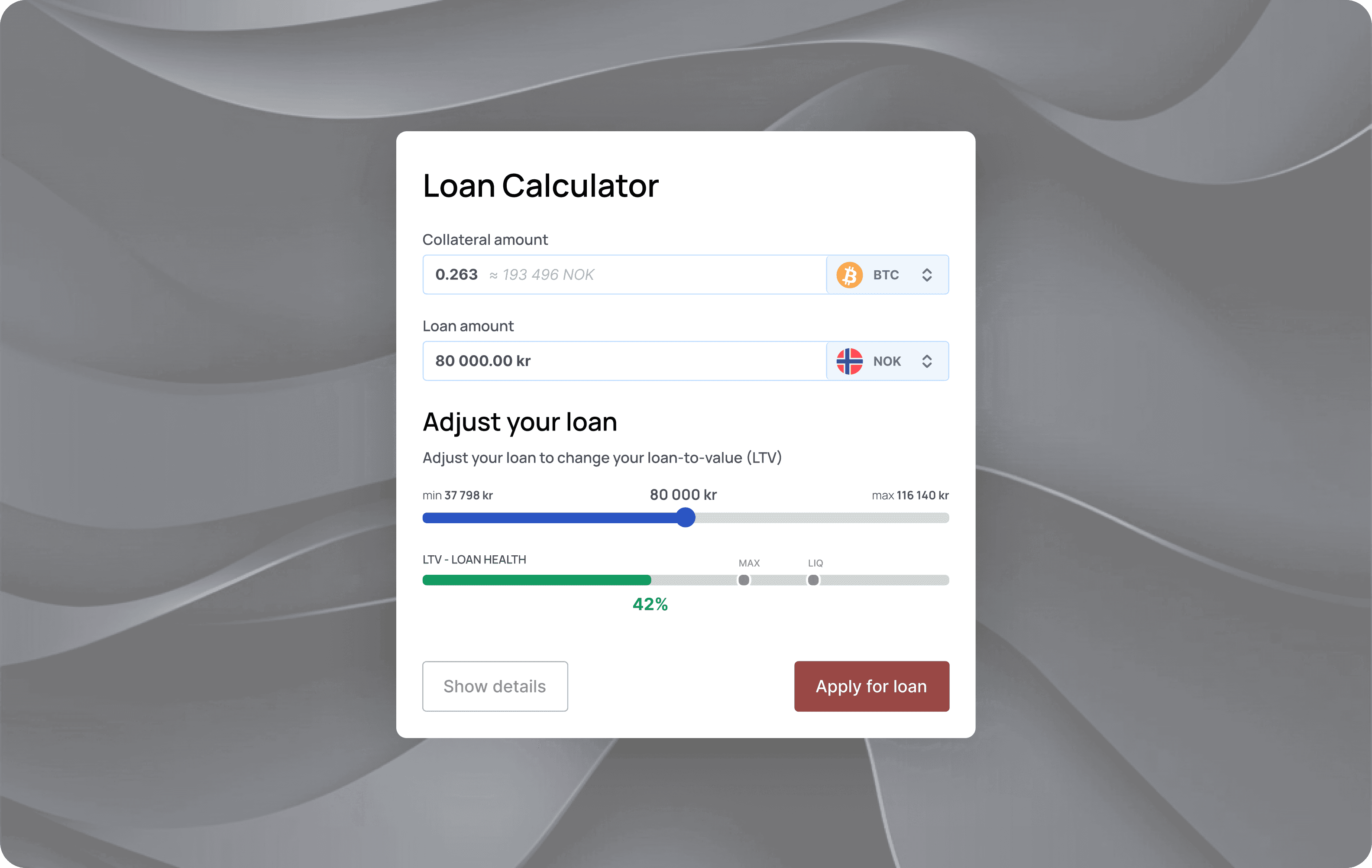

As a publicly regulated Norwegian brokerage, K33 required a solution that would bridge decentralized finance protocols with traditional financial custodial standards, allowing clients to leverage their crypto assets like Bitcoin (BTC) and Ethereum (ETH) as collateral for fiat loans. Providing their clients with real-world liquidity while adhering to the strictest regulatory standards.

Navigating a Complex Regulatory Landscape

A core challenge of this project was navigating the uncharted regulatory landscape around digital asset lending, requiring a flexible, iterative approach to development. Our team worked closely with Norway’s foremost regulatory legal experts, refining the platform’s architecture to meet evolving compliance standards. This collaborative approach involved multiple development pivots as we incorporated feedback from legal reviews to align with the latest regulatory guidance. The result was a solution that meets MiCa (Markets in Crypto-Assets) requirements and is fully auditable to ensure transparency and security.

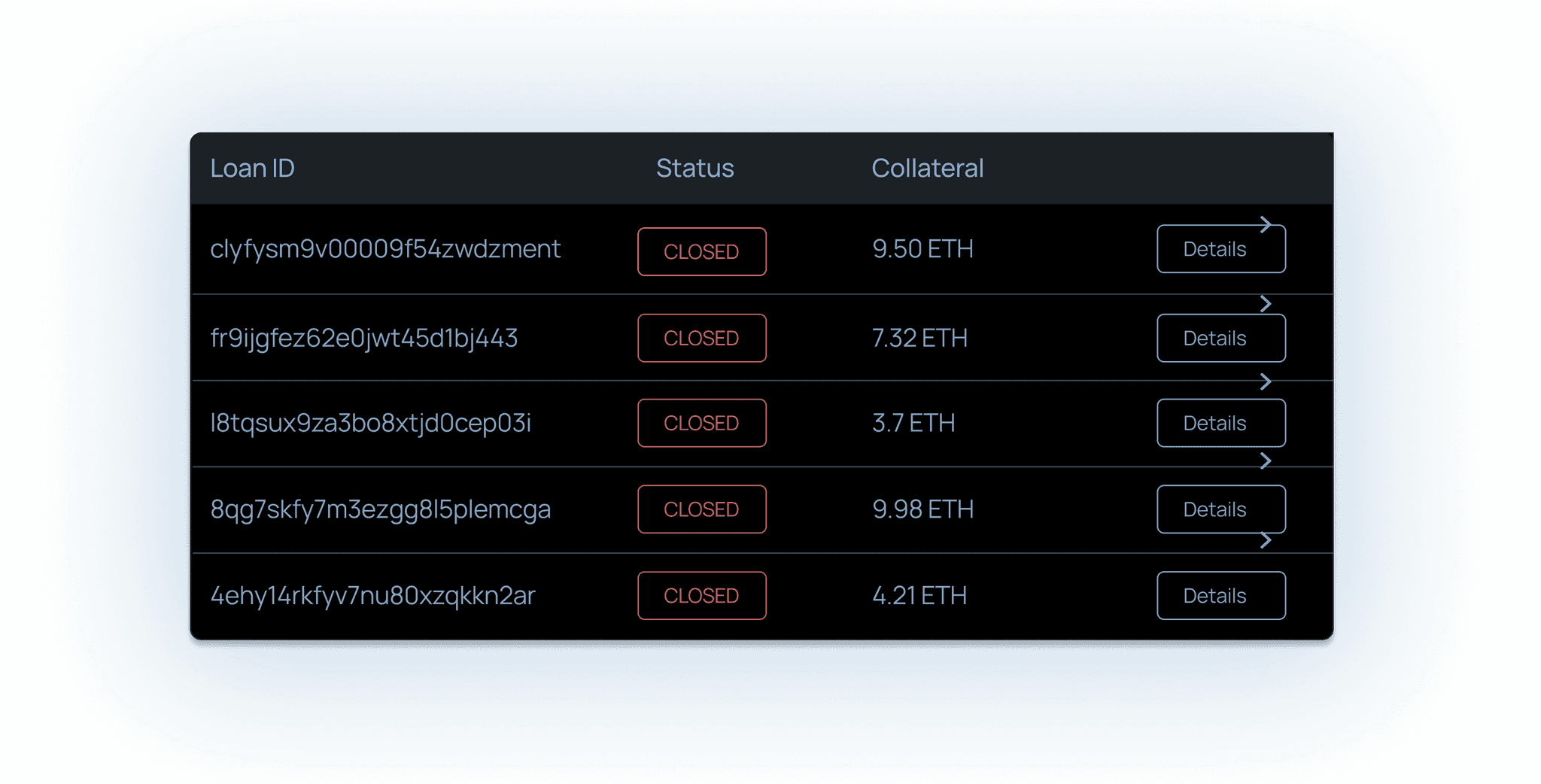

MiCA Compliance, admin and auditing tools

Using our domain knowledge in MiCA regulation and banking auditing, we developed a powerful admin dashboard as part of the MiCA-compliant solution. The dashboard provides K33 with a custom ledger and full oversight of all loan activities, enabling comprehensive control and efficient customer support. With its intuitive design, the dashboard empowers K33 to monitor transactions, address client needs, and maintain operational transparency with ease.